The “Chasm” between Technology Convergence and Business

Originally posted on www.tylerjohnsonconsulting.com.

I recently came across Geoffrey Moore's recent YouTube video, Is Your Business Model Being Disrupted? The Era of Code Halo... and it triggered a few thoughts.

First, I think Geoffrey Moore and guest Malcolm Frank, author of book on Code Halos or “digital footprints” are definitely on the right track on their thinking around SMAC – “social, mobile, analytics, cloud” (And I will buying and reading the book – unless someone wants to send me a free copy…). Gartner calls it "Nexus of Forces" – another term I’ve heard is technology convergence. The reality is that these new technologies in various ways are being used to create new business models that are disrupting every industry from publishing to retail and beyond.

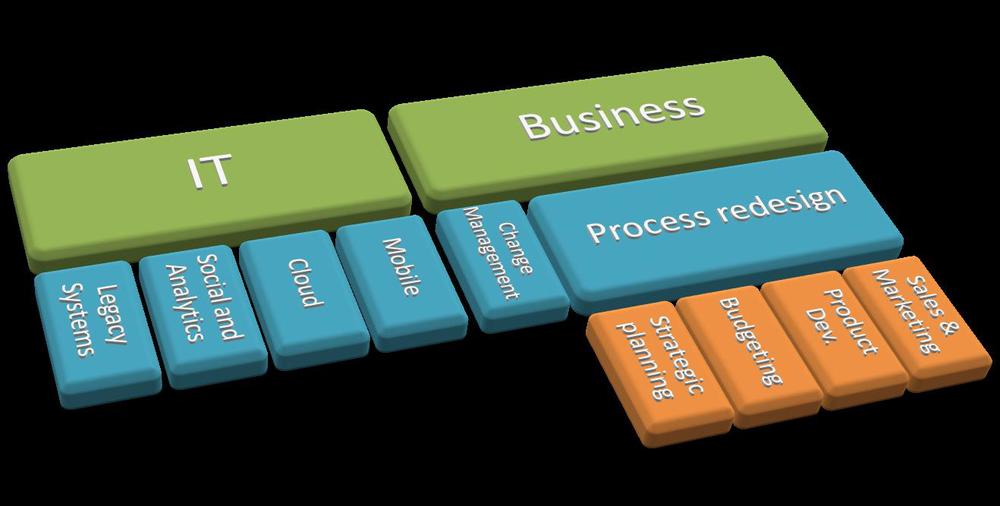

In particular, I like this framework from the video: (Let’s call it “Geoffrey’s SMAC down”.)

What we are talking about is adoption of these radically new technologies as a weapon to disrupt your industry. The massive challenge here (as discussed in the video) is that this framework represents pulling together a daunting set of skills and knowledge that few companies have in house. Sounds like an opportunity for consultants, right? While that may be true, (Moore and Frank are consultants after all J) that’s just the beginning. IT and business executives will need to develop new skills, new business processes have to be developed and implemented, organizational evolution will need to occur. You could hire Chasm, or Cognizant, or KPMG, or Deloitte, but I don’t believe that is enough if you’re the right people in your organization don’t understand the interplay between technology and business in this context. Change is hard because it requires making the right investments and right tradeoffs in the right places; this is why most industries will eventually be disrupted by new entrants with only few surviving incumbents. To understand this more fully, let me take you through a thought experiment.

Let’s look at a hypothetical large retail banking institution. The IT folks are thinking about virtual desktop (VDI) solutions as a way to reduce cost, improve security. Leadership is thinking about their M&A strategy, litigation, and growing profits. How could VDI transform their business?

· M&A – grow revenue be accelerating integrations, make acquisitions more accretive. How? By deploying VDI, the bank could move an acquisition’s remote offices’ core banking software over instead of integrating two systems and replacing all the local PCs. (They probably need a private cloud solution as well)

· Litigation – total control over all data by not letting it leave the datacenter. This reduces the risk of employees stealing customer data, hacking/tampering with software installed at the remote office, etc.

· Profit – reduce cost of building and supporting new remote locations. Enable new form factors for remote locations. Remote tellers? (Implies linkage with a mobile strategy)

Unfortunately, each group has their own POV and has a hard time communicating their needs and the implications of their needs to the other. As a result, communication reduces down to the lowest common denominator – “cost reduction”. They’re using the current budgeting process. Based on NPV, EVA, payback, etc., this process doesn’t take into account the other benefits of a VDI solution. They need a new way to prioritize investments; soft benefits need to quantified, which requires understanding of both the technology and the business impact of the technology, not an easy task. To trust the process, producers and consumers of the analysis need to understand both the technological and business implications of the transformation. The organization itself needs to change, i.e. what organization, roles, and skills are required to successfully complete such an exercise? You could argue that you just go do it, but then how do you measure this project against others, like a big data (analytics) project that combines customer data with digital footprints from social media to create new financial products, hyper targeted demand campaigns and the like? And we haven’t even addressed the bigger question of how SMAC could create new opportunities for business model transformation - like creating a platform for crowd sourced microloans to disrupt the check cashing industry. On the other hand, maybe that's the type of thing that could disrupt the bank as well...

The point I’m making here is that it is not enough to look at how SMAC could transform your business model and create new sources of competitive advantage; you also need to look at how SMAC could transform your industry, and how your company has to evolve to embrace all this change.

Let me know what you think.