How Carly Fiorina' s Mistake Put Me on a Path to Entrepreneurship

None of this would have happened if Carly hadn’t made a mistake in firing all those HP salespeople and I hadn’t taken a risk.

Although successful with these large companies, something was always missing. I yearned to be able to create something on my own, and I’ve just taken an even bigger risk. After 12 years of planning, I left Rackspace in January to join the ranks of the entrepreneurs (or unemployed as some like to call us).

The aftermath of the 2002 acquisition of Compaq by HP was hard for many of us.

Carly Fiorina's "adopt and go" policy and general economic malaise had resulted in layoffs of entire departments; few groups were left unaffected. My group, the Richardson, VLSI Lab, based in Richardson, TX was no exception.

I remember a "coffeetalk" group meeting where managers lined up at the exit to grab subordinates who were slated for the “workforce reduction” program.

I'll never forget the knot in my stomach while "walking the gauntlet" and the feeling of relief when I passed my manager without incident. In 2002, I had 2 year old twins and had very little appetite for risk.

By the way, did anyone at HP really think re-branding layoffs as “workforce reductions” would soften the blow of being fired?

Kiran Vemuri, the engineer directly in front of me and my office mate was not so lucky. Or maybe he was – after being laid off, he eventually found his way to the Bay area and later spent 8 years with Apple. Not bad... (He works at a startup now, I think.)

A year later, I received an unexpected opportunity in the form of an email.

As part of Carly’s “adopt and go” policy, she had eliminated the bulk of the pre-merger HP enterprise sales organization and sales of HP-UX based (UNIX) systems sales were in free fall. Why did this mistake happen? As a veteran of the telecom sector (Alcatel), Carly had extensive experience with what was essentially a transactional technology sale. In other words, it was a relatively short sales cycle where price competition dominated and supply chain was the primary buyer. This approach fit well with a Compaq sales organization that was primarily focused on x86 “volume” server sales. It didn’t’ work well with sales of HP-UX systems, an $8 Billion HP business at the time, however. The sales cycle was often more than 6 months and sales reps had a much more complex sale on their hands. They needed to be able to understand and communicate the value proposition for servers running massive enterprise applications like Oracle and SAP. Buyers were often the technologists themselves, not supply chain. In other words, she thought the HP legacy sales force was "lazy".

Because most of the folks who could sell HP-UX servers were gone, Dan Brennan, the VP of HP-UX sales, put together a retraining program to train engineers to become sales people.

I’ll never forget the email – it came from our lab manager on a Sunday night and we had until only Wednesday to respond. It was like she didn’t want to send it but had to, probably because non of the volunteers would be back-filled and she had deadlines to meet. Volunteers would go through 6 weeks of sales training for this pilot and would then enter the sales force for a 6 month pilot.

I was about to enter the SMU Cox MBA program and this was a great opportunity to pivot my career. It was risky though. Layoffs ware probably not over and if the pilot program wasn’t accepted, we were pretty much at the front of the line for layoffs (despite assurances to the contrary).

Out of over 150 engineers in the HP Superdome chipset and microprocessor labs, Scot Heath, Jody Zarrell and I were the only ones to volunteer. (Since then, at least a dozen others have told me they wish they had signed up.) Scot, Jody and I weren’t the only folks in the program however, there were about 25 of us. Most were from the True64 Unix and Alpha engineering teams from the Compaq side. I guess they saw the writing on the wall as those programs were all gutted in short order.

It was a wonderful summer: We went through six weeks of training and soon found ourselves back in our respective homes across the US on various sales teams.

About 3 months later, Carly was on a worldwide tour of HP offices to communicate with employees about the new “end to end portfolio” strategy for the combined HP-Compaq. What a load of garbage, but she made it sound really, really good. If you’ve never seen her speak in person, her charisma and presence are simply stunning. I’m not at all surprised to see her in politics.

I decided that this was a great time to flex my new sales muscles in front of the more than 700 HP employees packed into the Richardson hotel conference center. My heart felt like it was pounding out of my chest as I stepped up to the microphone to ask my question.

Carly: Hi, what’s your name?

Me: Hi, I'm Tyler Johnson.

Carly: Oh, great name, my first boyfriend’s name was Tyler.

(Silence – you could have heard a pin drop while her statement put me off script and I paused.)

Me: I’m sorry but I’m taken.

(All 700+ employees, including Carly, explode with laughter for several seconds until it quiets down enough for me to ask my question)

I can’t for the life of me remember my question…

A few months later, the pilot program changed hands again with a management reorganization and the sales program was in danger of being cut. I remember holding my new twin daughter in a common area of the Scottish Rite hospital in Dallas after her hip exam waiting for a call from a new manager I barely knew to notify me if I had a job or not.

(Yes, I have 2 sets of twins! And I’m now an Entrepreneur?)

Good news, I still had a job.

I remember being really afraid of losing my income during such a critical time but it all worked out. The next 10 years saw great success: I graduated with high distinction from SMU with my MBA and I’ve had a distinguished career with HP, then NetApp and most recently with Rackspace. (all great companies)

None of this would have happened if Carly hadn’t made a mistake in firing all those HP salespeople and I hadn’t taken a risk.

Although successful with these large companies, something was always missing. I yearned to be able to create something on my own, and I’ve just taken an even bigger risk. After 12 years of planning, I left Rackspace in January to join the ranks of the entrepreneurs (or unemployed as some like to call us).

I’ve already made mistakes: I’ve been through 2 iterations already and am in the process of starting a third.

Success consists of going from failure to failure without loss of enthusiasm. – Winston Churchill

My experience has taught me that a combination of taking calculated risks and tenacity will take me to a better place. And that place is probably nowhere near what I imagined it to be. Putting myself out there and being willing to work harder and longer than others is what has and will continue to make all the difference. Even if I’d been laid off along the way, it wouldn’t have mattered. Many or even most of the folks laid off at HP and other places I’ve been ended up in much better situations. I’ve learned that if you focus on improving and working hard, the risk of losing your job is perceived, not real.

Two roads diverged in a wood and I - I took the one less traveled by, and that has made all the difference. – Robert Frost

David Litman, co-founder of hotels.com taught me the difference between real and perceived risk in a conservative entrepreneurship course I took that he taught at SMU back in 2004. Most people over estimate the risk of being an entrepreneur and underestimate the risk of having a “steady” paycheck. Why? One word – fear. And not just fear, but irrational fear.

Are you willing to work harder and longer than your colleagues, engage in careful planning for years only to fail multiple times before you succeed, give up on materialist expectations for a particular standard of living in the near term (and possibly long term), and trust yourself to do something remarkable?

If so, it’s a race worth running and it’ll take you to a better place.

Thank you to all the people who've helped me on this amazingjourney so far.

I’m currently in pre-launch startup mode in the cloud computing space – I’m open to collaboration and/or I’d love to hear your thoughts, ideas and feedback.

For more insights, read my blog at www.contechadvisors.com/blog or follow me on Twitter at @Tyler_J_J

Will GE's Industrial Cloud Flourish Like AWS or Fizzle like New Coke?

It's all about user generated data. You might think that GE is a product company, and you'd be right. But it's also a services company that services millions of industrial devices in the energy, transportation, healthcare, and manufacturing sectors. These devices create literally exabytes of data, data which GE currently uses to service and maintain it's customers equipment and gain insights on product design, and in the future will be used for much more.

The year was 2011.

I was attending Cloud Connect in Santa Clara and having a coffee with Victor Chong, my friend and colleague from the HP days. He had just wrapped up a mobile app startup and was settling into a new job at eBay. While we had a nice time catching up, there was something he said that stuck with me.

One of the main things he learned from his experience in the brutal mobile app space was that it was "all about the data". You can build the best app in the world, but eventually, the owners of the data will find a way to squeeze your profits.

Back to 2015.

Seems obvious now doesn't it? With Facebook, Google, Uber, etc., we see how companies use data to transform industries and gain and/or maintain market dominance. Build a gigantic network of users, use the data you get from those users to dominate - pretty simple right? (Notice I didn't say "easy")

What does this have to do with GE's Predix Cloud Announcement?

Everything.

It's all about user generated data. You might think that GE is a product company, and you'd be right. But it's also a services company that services millions of industrial devices in the energy, transportation, healthcare, and manufacturing sectors. These devices create literally exabytes of data, data which GE currently uses to service and maintain it's customers equipment and gain insights on product design, and in the future will be used for much more.

With $148+ Billion in sales, GE holds a sizable chunk of the industrial IoT (Internet of Things) market captive

In a stroke of genius, Amazon's Jeff Bezos, Chris Pinkham and others were able to develop a general purpose technology platform (public cloud) for a specific corner use case (ecommerce book store) and then extend that technology to create & transform other markets. In other words, for AWS to exist, they needed amazon.com to exist first. And for Amazon the bookstore to be sustainable and have the scale that would later enable AWS and Amazon as a general purpose eCommerce site, they had to have millions of customers as a bookstore first.

Build a network of users in a narrow corner case you can dominate, build a general purpose extensible technology platform to service that business, use that platform to dominate other segments. That is what GE is doing - they already have the network of devices, and the platform is there as well.

"GE businesses will begin migrating their software and analytics to the Predix Cloud in Q4 2015" - GE Press Release

There are others using the same strategy:

- Tesla: Started with developing technology to dominate the luxury electric car market - moving into general automotive and energy sectors.

- Uber: Built a multi-sided platform that connected millions of riders and drivers - moving into package delivery.

Can GE compete with the cloud heavyweights like Amazon, Google, MSFT, etc?

Did I say it's all about the data? I did, but it's also all about the execution. Here are some pros and cons for why GE might be successful with Predix Cloud.

Cons:

- Cloud incumbents already have a significant head start in operating large scale public clouds. Things like billing, SLA management, capacity management are far more complex when you're a cloud operator.

- Incumbents have a massive stable of world class talent and innovation track record - indicators that the pace of innovation isn't likely to slow any time soon.

- Many incumbents have strong leadership with experience leading companies in quickly changing industries.

Pros:

- GE has plenty of talent and experience as an IT service provider. Gartner others estimate that enterprises spend anywhere from 3% to 6% or revenue on IT. This puts GE's annual IT spend at between $4.5 and $9 Billion. They're already a major player in IT and if you assume that 40% of the spend goes to employees and a fully burdened IT salary is $150k, then they've got between 12 and 24 thousand IT employees.

- They're not starting from zero. As Barb Darrow mentioned in her article about the GE announcement on Forbes, GE invested $105 million in Pivotal over two years ago. The number of Cloud Foundry, big data and cloud experts at GE is not public knowledge, but if they'll spend $100M in Pivotal, I bet they'll have invested heavily in talent as well.

- The field is wide open. Public cloud infrastructure, as it exists today, is not yet ready for the scale needed to handle 100's of billions of devices. McKinsey, for example, estimates that the market for IoT devices by 2020 will be 20-30 billion units.

- They're the experts in industrial control systems.

- They're not going it alone. GE is developing partnerships with key technology players like Intel and Cisco. Look for more of this type of ecosystem development in the near future.

According to Jack Welsh, former CEO, GE would not compete unless it thought it could be first or second in an industry.

I don't know if that's still a core tenet of GE leadership, but I'm guessing they think they can lead the emerging Industrial Internet. And I wouldn't bet against them.

Agree? Disagree? I'd love to learn from you.

How to think about Cloud Computing's "Alphabet Soup"

As mature enterprises look to gain flexibility and customer intimacy while startups look for speed and new business models, a federated model for IT is emerging. Some call it "hybrid" cloud (don't get me started on all the cloud-washing going on) But it's really more than just the infrastructure.

The situation in IT has become ridiculously complex.

ServiceNow, Mulesoft, Stratacloud, New Relic, Splunk, Basho Technologies, Rightscale, App Dynamics, Solar Winds, NexDefense and "8000" other companies occupy the increasingly crowded IT tools space. Consider the infrastructure providers of things like converged infrastructure and hyper-converged infrastructure. And don't forget about traditional tech vendors like IBM and VMware.

As mature enterprises look to gain flexibility and customer intimacy while startups look for speed and new business models, a federated model for IT is emerging. Some call it "hybrid" cloud (don't get me started on all the cloud-washing going on) But it's really more than just the infrastructure.

Depending on your situation, you could have a need for applications you manage yourself in your data centers, applications hosted by others in their data center in a managed services or SaaS model or any one of potentially thousands of combinations of in house and third party combinations.

How does one navigate all this complexity? Established companies, especially those over say $50 million in revenue, are likely to have a need for multiple platform types for the foreseeable future.

1. Know where you're going. IT strategists need to understand that the future of IT dictates a service management model that is capable of delivering IT across the increasingly complex landscape of IT delivery models. This federated model for IT service management is not possible today, but pieces of it do; companies need to begin preparing for it and will capture significant competitive advantages along the way, which leads to the second point.

2. Minimize rework (or "Technical Debt"). We can take a page from Jeff Bezo's mandate to Amazon employees in 2002 where he directed his developers to focus on standard interfaces (APIs) and modularity among other things. This is what lead to the creation of AWS and cloud computing in general. Companies need to adopt a zero new technical debt stance for developing internal applications as well as carefully consider the potential for creation of technical debt when considering tools, architectures, and vendors for new projects. Bezo's list is here:

- "All teams will henceforth expose their data and functionality through service interfaces.

- Teams must communicate with each other through these interfaces.

- There will be no other form of inter-process communication allowed: no direct linking, no direct reads of another team’s data store, no shared-memory model, no back-doors whatsoever. The only communication allowed is via service interface calls over the network.

- It doesn’t matter what technology they use.

- All service interfaces, without exception, must be designed from the ground up to be externalizable. That is to say, the team must plan and design to be able to expose the interface to developers in the outside world. No exceptions."

3. Start with a Hybrid Cloud foundation. While hybrid cloud service management matures, every company will be presented with opportunities to become more digital. In the order of operation, start with developing a hybrid cloud delivery capability from an organizational perspective as well as architectural perspective. This is not just tech, although tech is a part of it.

4. Focus on the customer. Business process, application enhancements, and infrastructure enhancements should be prioritized based on improving customer intimacy. This is all about:

- Interacting with customers where they are (social media).

- Empowering your employees by providing them tools to communicate to other employees and customers, access to data they need at the time they need it for insights, and the ability to work effectively wherever they are.

5. Get Help. Very few organizations have the capabilities required for a digital transformation. Given the complexities, and knowledge required around cloud service management, security, business process redesign, successful companies will recognize this and build ecosystems of partners and vendors to bring all the needed skills together. Companies that try to do this by hiring alone will usually fail.

Agree? Disagree?

Let me know what you think by commenting on this post or reaching out to me directly!

Will your IT strategy turn you into the "Walking Dead"?

To be relevant to the business, CIOs have to talk about more than cost and uptime – they need to be able to build momentum by educating their business counterparts on how these emerging technologies can transform a company from a business perspective.

Why is CIO turnover down? One word – Digital.

It wasn’t long ago that the joke was: “My 2 year car lease will last longer than the CIO”.

Times have changed, though. With the average CIO tenure approaching 5 1/2 years, he or she can probably pay off a standard car loan on that brand new Tesla model S they’ve been eying.

Why? CIOs are increasingly involved in business strategy as IT moves from a cost center to an investment center. And strategy takes time. Companies are also now competing with strange new entrants:

“Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.”

- Tom Goodwin, TechCrunch

Digital natives are disrupting industries across the globe – this is why outgoing Cisco CEO John chambers talked about the coming disruption ahead driven by digital.

“Forty percent of businesses… will not exist in a meaningful way in 10 years" and “70% of companies would "attempt" to go digital but only 30% of those would succeed.”

- Cisco CEO John Chambers

At either a conscious or subconscious level, most senior leaders understand the need to make technology a more deliberative part of their strategy planning process, (hence the growing importance of the CIO role in strategy) but change is difficult, and transformative change is extremely difficult.

“The IT discipline within most enterprises has developed a set of behaviors and beliefs over many years, which are ill-suited to exploiting digital opportunities and responding to digital threats.”

-Gartner

Before anything happens, the executive dialogue needs to change. Most business spend between 3 and 5 percent of revenue on IT. Cost cutting in IT can at most shave off 1% of overall IT cost.

“I went to the CEO and told him I could cut IT costs by 20% by moving to the “cloud”. He responded that a 20% reduction in a cost that was 3% of revenue, or a total margin improvement of 0.6% wasn’t exactly “strategic”. He also said my predecessor tried the cloud and the way it was implemented it actually turned out to be more expensive than before.”

- Newly “Liberated” CIO job seeker

To be relevant to the business, CIOs have to talk about more than cost and uptime – they need to be able to build momentum by educating their business counterparts on how these emerging technologies can transform a company from a business perspective.

Once the leadership team is on board, cloud, big data, social and mobile all have to be part of a cohesive technology and business strategy of transforming the business over time. And this will take time and investment, if companies wait until they’re being disrupted by newcomers, it’s already too late.

The CIO plays a pivotal role in all of this, which is to bridge the business and technology strategy chasm.

A great first step towards digital transformation for CIO is to develop a hybrid cloud strategy that enables both migration and maintenance of legacy applications and incorporation of new technologies like big data analytics, data visualization, social data integration, etc.

Design your hybrid cloud foundation to minimize technical debt (rework)

15 years ago it was virtualization, then it was cloud, and now we’re seeing the emergence of new container technologies like Docker emerge – all layers of abstraction intended to increase utilization and improve flexibility. Even with all these technologies, IT infrastructure in general is still dramatically underutilized when compared to other types of capital equipment.

It always amazes me to see companies still managing IT assets by spreadsheet, even virtual ones.

Develop a service management strategy that is designed for hybrid cloud architectures and is easy to deploy and manage. Key attributes are security integration, 3rd party vendor interoperability, reference architectures, extensibility with standard APIs, intelligent automation of standard management tasks like provisioning and de-provisioning of virtual and physical resources, managing role based access, capacity management, SLA management and monitoring.

Once a solid foundation is in place, target applications with the best ROI in terms of improving a company’s business. These are typically applications that are customer facing, or contain data that, when combined with other data and platforms (i.e. social, mobile) and/or could be most easily ported to hybrid architectures.

CIOs also need to gradually transform their organizations from a capabilities perspective and move their organization from traditional methods like application up time, response time and traditional Capex methods of measuring infrastructure consumption to business outcome based metrics. When moving from traditional on premise to hybrid, it’s a good time to implement tools that can not only accurately measure infrastructure usage in both on and off premise environments ties to applications, but can also be easily integrated into other components of a digital enterprise platform, like using Flume or Sqoop (depending on data source) to integrate infrastructure cost and performance data into a Hadoop cluster when data analytics is tying these costs to social media (tweets about your product for example) Imagine correlating user interface design changes to Facebook likes for example – very powerful.

Change is hard - it will take organizations intense effort over a span of years to become truly digital. All functions from IT to HR, finance, marketing, sales, R&D, and operations will have to work together to to transform their organizations and business processes in addition to technology. More than ever, the CIO must provide business leadership in additional to technical leadership..

Let me know what you think by commenting on this post or reaching out to me directly!

If you need help with your technology strategy, let me know - I can help.

6 Reasons your Data is More Secure in the Cloud

There are no easy answers, but the traditional thought is that data kept in inside your data center is safe because it's behind the corporate firewall. That used to be true, but no longer.

Credit: StockMonkeys.com

Originally posted on LinkedIn

This is a complex topic.

There are no easy answers, but the traditional thought is that data kept in inside your data center is safe because it's behind the corporate firewall. That used to be true, but no longer. With sophisticated tools and techniques developed over the last 5 years by organized hacker syndicates in places like those in Eastern Europe, government sponsored hacker groups, and the rise of hacker ecosystems, pretty much any corporate firewall is now vulnerable.

We've seen multiple recent high profile breaches like the ones at Target, Home Depot, and Sony, but most don’t realize just how big the problem really is...

A recent survey conducted by Symantec indicates that cyberattacks against big companies surged by 40% in 2014 and “Five out of six companies employing more than 2,500 people were targets of cyber attacks last year”

If these are mostly attacks on traditional on premise enterprise systems, what does this have to do with cloud computing?

The new model is that one has to assume hackers will at some point penetrate the perimeter firewall and security policies must be in place for every node in the network.

With stagnant budgets, IT departments have struggled to develop and retain the security expertise required to put the effective controls in place that keeps their data secure. This is where cloud and other service providers can help. The way I see it, cloud providers have six major advantages when it comes to security:

- Because security has been such a big issue in cloud computing, cloud providers typically prioritize security higher and invest more resources than the typical enterprise. Cloud technology providers usually build robust security controls in from day one.

- Cloud service providers are targeted far more than traditional enterprises and learn from being involved in these cyberattacks. As a result, they implement controls which are much more stringent than those typically used by enterprise IT departments.

- IT security experts are expensive and can be deployed to help multiple companies utilizing a service provider model

- Cloud providers have the ability to leverage security best practices developed with one customer across their entire customer base

- Cost to develop security models and tools is spread across multiple customers.

- Companies can tap into a set of best of breed IT security partnerships that cloud providers typically develop.

The bottom line is that the people, policies and tools in place to keep your data secure are much more important than the location of the data itself.

Cloud providers are increasingly a key component of companies’ enterprise data security strategy but IT departments still need to own their overall strategy. Here are some of the key components of a data security strategy:

- Data Encryption: If firewalls are now vulnerable, data needs to be encrypted at rest.

- Access control: SSO and other access controls need to be in place as part of an identity management strategy. In the old model, users inside the firewall were assumed to be trusted. In the new model, users are assumed to be untrusted and strict access control needs to be in place at the device level.

- Governance and Audit: Data should not be available to all personnel and copies of sensitive data should tracked and destroyed when no longer needed. Best practices like limiting access to passwords, robust password policies and ensuring that passwords are stored in encrypted data stores are a must.

- Monitoring: Threats coming from both inside and outside the company need to be monitored at the device level.

- Testing – All IT departments should have a rigorous penetration testing strategy for both on premise and cloud environments.

By working with the right cloud provider, the task of securing your enterprises’ sensitive data can be made easier. Thanks to Jim Page for asking the question that inspired me to write this post.

Why Tesla' s Home Battery is Just the Tip of the Iceberg

This battery, along with electric autos, recharging stations, solar cell modules, residential and commercial solar installations and financing are all part of a carefully orchestrated plan launched years ago by Elon Musk and his colleagues to dramatically accelerate the transition to clean renewable energy.

You've probably heard about Tesla's announcement of a new division, Tesla Energy and the POWERWALL, a sleek and stylish battery for the home. Not a big deal, right?

Wrong.

This battery, along with electric autos, recharging stations, solar cell modules, residential and commercial solar installations and financing are all part of a carefully orchestrated plan launched years ago by Elon Musk and his colleagues to dramatically accelerate the transition to clean renewable energy.

To understand the plan, you have to look at Tesla and SolarCity as part of a unified strategy

To solve for sustainable energy, the key questions Musk would need to ask are:

1. Where is the opportunity to make the quickest and biggest impact?

2. How does one attract investment in renewable energy to create the technologies, infrastructure, markets, and ecosystems required?

3. What critical parts of the overall value chain are inhibiting opportunities for economic profit?

4. How does one create the sustainable competitive advantage required to provide a source of cash flow needed to fund further investments?

Although some see SolarCity as primarily a solar residential installation company and Tesla as primarily a car company, the reality is that Musk’s companies have operations across much of the energy value chain. This distribution of investments and activities is not random. Musk’s focus has been on elements of the value chain that tend to have the biggest impact on sustainability and present the greatest economic impediment to creating a superior cost alternative to the fossil fuel value chain. It’s also not a coincidence that these components of the value chain also present the largest opportunity for sustained competitive advantage and profits.

What's the biggest obstacle to renewable energy? Distribution.

For energy to be utilized cost effectively, it has to be distributed to energy consumers in a form they can use. Unfortunately, over 70% of energy in the US is distributed via liquid, gas, and solid fossil fuels, not electricity. If we wanted to reduce fossil fuel consumption by half, we would have to more than double electrical distribution capacity, which would require truly massive capital investment given that utilities spent nearly $100 Billion on transmission over the last 10 years in the US alone.

What solves the distribution problem? Batteries

In addition to making electric cars a successful business, the growth of Tesla’s capabilities with respect to electrical storage stands to benefit the development of a distributed energy production model. For example, Walmart already has Tesla batteries installed at 11 locations in California. Once Tesla’s Gigafactory is complete, Musk will be able to use high volume battery production to both accelerate penetration of the automotive market with the mid-market Tesla Model III and help extend SolarCity’s market share leadership by enabling commercial and residential customers to become energy self-sufficient with energy modules containing both solar cells and batteries.

Batteries and distribution are just one part of a complicated energy picture. I've put together an extensively researched whitepaper that details Elon Musk's motivations and strategy to accelerate the transition to clean renewable energy.

In this whitepaper, you'll see how Musk's strategy follows these 6 key principles:

- Start with the big picture view

- Start in a niche small enough to dominate

- Execute like crazy

- Only move into mainstream market segments when you can create real competitive differentiation

- Prioritize investments in the elements of the value chain that “aren’t good enough”

- Integrate across boundaries within the value chain to create economies of scope

Read the whitepaper, comment on this post or reach out to me directly. I'd love to hear what you think.

HP's Cloud Strategy Could Play Right into IBM's Hands

Disruption is in the air. While HP and IBM both grapple with what has become a long term downward revenue trend, Amazon, Google and others are enjoying the spoils of disruption. To combat the threat, ...

Disruption is in the air. While HP and IBM both grapple with what has become a long term downward revenue trend, Amazon, Google and others are enjoying the spoils of disruption.

To combat the threat, both HP and IBM are doubling down hard on cloud computing, but as HP CEO Meg Whitman mentioned in the Q1 investor call last Thursday, the key to managing the disruption will be to manage the decline in revenues:

“The water is now going to stop draining out of the bathtub as fast as it has, so the water that we pour in ought to lead to a rising level in the tub” - HP CEO Meg Whitman

Probably not the way I would have worded it, but I get her point.

Will the growth from HP and IBM investments be enough to stop the revenue declines? Eventually, probably, yes, but it’s difficult to say when growth from the new business will exceed decline from the old. There is no doubt about the scale of investment. During IBM CEO Ginni Romnetti’s analyst meeting last week, she mentioned an additional $4 Billion investment in emerging technologies like social, mobile, analytics and cloud; this is in addition to the $2 Billion acquisition of Softlayer as well an incremental $1.2 Billion in additional cloud capacity. The Eucalyptus acquisition is an example of HP's investments in cloud computing . That said, all appearances are that IBM’s total dollar investment in cloud is far greater than HP's, with HP appearing to rely on a more organic growth strategy that leverages Openstack to quickly gain capabilities.

Will HP’s strategy work?

If co-opted correctly, open source can be an effective defensive weapon against disruption, but the key is to maximize the benefit of your investments; I think IBM is doing a better job on that score than HP.

As this chart indicates, IBM’s relative contribution to the Openstack code base has declined while HP's has increased. Even though Openstack is a key component of IBM's cloud software portfolio, HP is now the leader in contributions to Openstack. So what happened to those developers? Did IBM lose them to HP and others? Unlikely. What’s more likely is that these developers are now working on proprietary enhancements and integrations into IBM’s software portfolio. If true, then the more HP invests in Openstack, the more IBM benefits as IBM continues its aggressive investment and acquisition strategy while continuing to use Openstack as a core technology. That’s not to say that HP won’t see success, it’s just that IBM seems to be taking advantage of a better position, and arguably better understanding of how best to use open source as a competitive weapon.

What do you think? Who will end up on top?

Or do you think it doesn't matter since the Amazons and Googles of the world will crush the IT incumbents?

Cloud Wars: Who's Winning and why it doesn't Matter

What is the industry response to the AWS advance?

Meanwhile, IBM, HP, Microsoft, the EMC/VMware federation and other incumbents have taken notice and are investing heavily in new technology to help customers simultaneously achieve the business benefits of cloud computing, minimize migration risk and maintain platform stickiness. Case in point is ...

Nine years of cloud computing and counting...

The year was 2006. While Andy Jassy and Jeff Bezos were inventing a whole new way of delivering technology over the Internet at Amazon, I was busy at HP trying to convince customers to move their applications from legacy IBM mainframe systems to UNIX systems. As you might guess, that didn’t go too well; I was stunningly unsuccessful convincing folks to move off mainframes. (Fortunately, I could consistently beat quota by helping customers deploy standard UNIX workloads like Oracle and SAP.) The re-platforming cost and risk was just too great and an IBM sales rep would always come in at the 11th hour with a low-ball offer and a reminder of the risk and lack of experience with the new platform - and the deal died. I learned an extremely important lesson from that experience:

Don’t underestimate the power of those leveraging resistance to change

Fast forward to 2015 and the IT technology world is radically different, but some things haven’t changed. Although declining gradually, IBM’s mainframe ecosystem is still generating billions in revenue. Corporate IT is now largely virtualized but most application architectures are unchanged from when they ran on physical servers. Companies like Uber, Airbnb, and Netflix that were “born in the cloud” are disrupting their respective industries with technology from Amazon, Google and others, but over 90% of the Gartner estimated $3.8 trillion in 2015 worldwide IT spend will still be on legacy systems and services to support those systems. Why?

The answer is that most technology decisions are rational and those decisions depend on both the value and cost of changing technology. More on the value part of the cloud equation and why many companies are missing the point in a future post.

What is the industry response to the AWS advance?

Meanwhile, IBM, HP, Microsoft, the EMC/VMware federation and other incumbents have taken notice and are investing heavily in new technology to help customers simultaneously achieve the business benefits of cloud computing, minimize migration risk and maintain platform stickiness. Case in point is IBM's acquisition of and further investments in Softlayer while rumors swirl about reducing overall headcount. Many of us recognized the same pattern in the early 2000’s when leading telecommunications providers maintained their status as incumbents by turning a potentially disruptive new cellular technology into a way to combat new entrants, an approach described in Clayton Christensen's book, Innovator's Solution.

The idea is that current leaders can minimize disruption if they recognize the threat early enough and invest aggressively in new technologies and business methods to protect their industry position, even though new players are deploying new technologies in a way that disrupts the industry's predominant business model. Oftentimes, this requires carefully staged self-cannibalization. HP, for example, addressed this by keeping its cloud services organization separate from its enterprise services business unit (the old EDS business).

How is cloud computing disrupting the IT sector?

The pattern we are seeing in cloud computing at the moment doesn’t fit the classic industry disruption model. Unlike their colleagues in the retail and media sectors, IT industry leaders are fighting back by evolving their business models, making new investments and rapidly co-opting new technologies.

By some, this could be seen as a provocative statement

Is the growth of cloud computing disruptive? Absolutely, but it depends on your perspective of who is being disrupted. We can expect to see continued turbulence where a number of IT companies will not navigate the transition to the as-a-service cloud business model, but most of the biggest players will be able to maintain their position as industry leaders (although the order will likely change in the shakeout)

Traditional IT leaders are starting to see the results of their cloud efforts

As we see IT industry incumbents invest heavily in new capabilities and technologies and co-opt cloud innovation concepts, we are also seeing them aggressively work to maintain and extend their platform ecosystems. Those efforts are starting to generate results. By some measures, Microsoft is growing its cloud revenue almost twice as fast as Amazon, and IBM is only 2 percentage points behind.

Case in point: Even though Amazon AWS is the clear market leader with up to 75% share of cloud platforms according to Forrester, Microsoft has grown its cloud business from low single digit market share 3 years ago to as high as 25% at the end of 2014.

This is because of the mature Microsoft ecosystem combined with the gradual maturation of Microsoft cloud technologies. The key word here is ECOSYSTEM. Microsoft has 10,000’s of partners, a large mature enterprise sales force and a .NET platform that is nearly ubiquitous with Fortune 1000 IT departments. Because of this, they can leverage the high ground to gain cloud market share from AWS, Google and other new entrants and protect their base. Other leaders like EMC and IBM are employing a similar strategy. Does this mean that IBM and the other incumbents are out of the woods? No, but they're fighting back hard and aren't going anywhere anytime soon.

The Cloud Biome: A set of ecosystems emerge

While the new players led by Amazon and Google are growing their cloud ecosystems organically, established players are re-purposing their existing ecosystems of developer communities, resellers, technology providers, integrators, and service providers. This takes work: There are new winners and losers and capabilities have to be evolved but the results are unmistakable. Taking a closer look, we see a key subset of cloud platform ecosystems emerge:

- Amazon AWS

- Openstack – IBM, HP, Red Hat, Rackspace

- Microsoft Azure

- VMware/EMC

Other platforms may achieve critical mass in the future, but it’s clear these platforms are here to stay. One way of looking at this is to look at the number of jobs posted requiring competence with a particular platform. If you look at trends on the Indeed.com website, you will see skills related to all of these platforms in high demand. (Be careful how you read the results though, the high growth of jobs in the transportation sector skews the results.)

Do enterprises care who’s the biggest? No.

Every platform mentioned here has and will continue to attract its share of customers for the foreseeable future. Many enterprises will also standardize on multiple platforms depending on their current state, future state plans, and to spread out risk. Do we care which platform provides the best fit for any given situation?

Absolutely yes, but.....

I’d love to hear your thoughts; let me know what you think by leaving a comment below.

The “Chasm” between Technology Convergence and Business

I recently came across Geoffrey Moore's recent YouTube video, Is Your Business Model Being Disrupted? The Era of Code Halo... and it triggered a few thoughts....

Originally posted on www.tylerjohnsonconsulting.com.

I recently came across Geoffrey Moore's recent YouTube video, Is Your Business Model Being Disrupted? The Era of Code Halo... and it triggered a few thoughts.

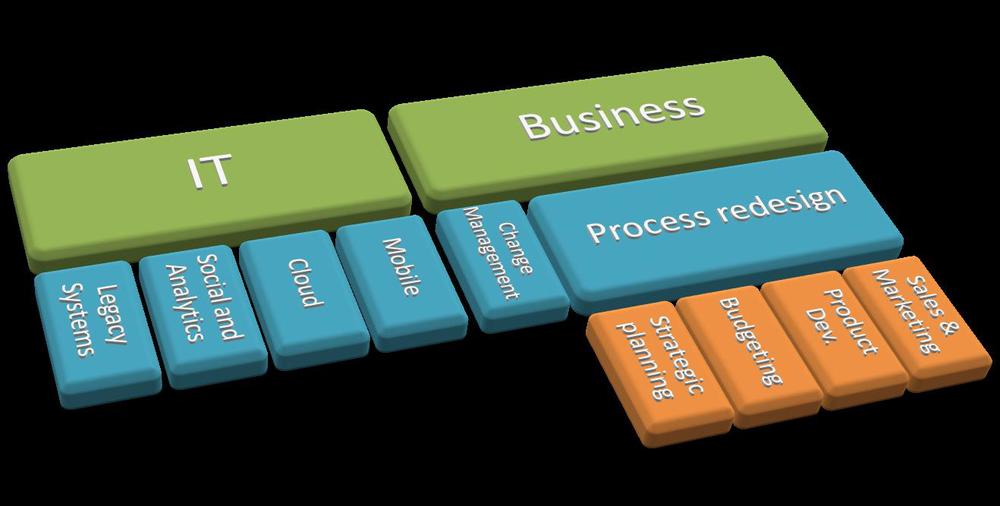

First, I think Geoffrey Moore and guest Malcolm Frank, author of book on Code Halos or “digital footprints” are definitely on the right track on their thinking around SMAC – “social, mobile, analytics, cloud” (And I will buying and reading the book – unless someone wants to send me a free copy…). Gartner calls it "Nexus of Forces" – another term I’ve heard is technology convergence. The reality is that these new technologies in various ways are being used to create new business models that are disrupting every industry from publishing to retail and beyond.

In particular, I like this framework from the video: (Let’s call it “Geoffrey’s SMAC down”.)

What we are talking about is adoption of these radically new technologies as a weapon to disrupt your industry. The massive challenge here (as discussed in the video) is that this framework represents pulling together a daunting set of skills and knowledge that few companies have in house. Sounds like an opportunity for consultants, right? While that may be true, (Moore and Frank are consultants after all J) that’s just the beginning. IT and business executives will need to develop new skills, new business processes have to be developed and implemented, organizational evolution will need to occur. You could hire Chasm, or Cognizant, or KPMG, or Deloitte, but I don’t believe that is enough if you’re the right people in your organization don’t understand the interplay between technology and business in this context. Change is hard because it requires making the right investments and right tradeoffs in the right places; this is why most industries will eventually be disrupted by new entrants with only few surviving incumbents. To understand this more fully, let me take you through a thought experiment.

Let’s look at a hypothetical large retail banking institution. The IT folks are thinking about virtual desktop (VDI) solutions as a way to reduce cost, improve security. Leadership is thinking about their M&A strategy, litigation, and growing profits. How could VDI transform their business?

· M&A – grow revenue be accelerating integrations, make acquisitions more accretive. How? By deploying VDI, the bank could move an acquisition’s remote offices’ core banking software over instead of integrating two systems and replacing all the local PCs. (They probably need a private cloud solution as well)

· Litigation – total control over all data by not letting it leave the datacenter. This reduces the risk of employees stealing customer data, hacking/tampering with software installed at the remote office, etc.

· Profit – reduce cost of building and supporting new remote locations. Enable new form factors for remote locations. Remote tellers? (Implies linkage with a mobile strategy)

Unfortunately, each group has their own POV and has a hard time communicating their needs and the implications of their needs to the other. As a result, communication reduces down to the lowest common denominator – “cost reduction”. They’re using the current budgeting process. Based on NPV, EVA, payback, etc., this process doesn’t take into account the other benefits of a VDI solution. They need a new way to prioritize investments; soft benefits need to quantified, which requires understanding of both the technology and the business impact of the technology, not an easy task. To trust the process, producers and consumers of the analysis need to understand both the technological and business implications of the transformation. The organization itself needs to change, i.e. what organization, roles, and skills are required to successfully complete such an exercise? You could argue that you just go do it, but then how do you measure this project against others, like a big data (analytics) project that combines customer data with digital footprints from social media to create new financial products, hyper targeted demand campaigns and the like? And we haven’t even addressed the bigger question of how SMAC could create new opportunities for business model transformation - like creating a platform for crowd sourced microloans to disrupt the check cashing industry. On the other hand, maybe that's the type of thing that could disrupt the bank as well...

The point I’m making here is that it is not enough to look at how SMAC could transform your business model and create new sources of competitive advantage; you also need to look at how SMAC could transform your industry, and how your company has to evolve to embrace all this change.

Let me know what you think.